nebraska sales tax percentage

The Nebraska state sales and use tax rate is 55 055. Depending on local municipalities the total tax rate can be as high as 75 but food and prescription drugs are exempt.

31 rows The state sales tax rate in Nebraska is 5500.

. The average cumulative sales tax rate in the state of Nebraska is 605. Nebraska Sales Tax Guide. Notification to Permitholders of Changes in Local Sales and Use Tax Rates Effective October 1 2022 updated 06032022 Effective October 1 2022 the village of Bruning and the city of Humboldt will start a local sales and use tax rate of 15.

Combined Sales Tax Range. As far as all counties go the place with the highest sales tax rate is Cuming County and the place with the lowest sales. How Does Sales Tax Apply to Vehicle Sales.

The state sales tax rate in Nebraska is 55 but you can customize this table as needed to reflect your applicable local sales tax rate. In addition local sales and use taxes can be set at 05 1 15 175 or 2 as adopted by city or county governments. A sales tax table is a printable sheet that you can use as a reference to easily calculate the sales tax due on an item of any price - simply round to the nearest 020 and find the row in the sales tax chart that shows the applicable tax for that amount.

It has changed 13 times since then and is now 55 percent. How to Register for Nebraska Sales Tax. Nebraska S Sales Tax Nebraska Drops To 35th In National Tax Ranking Taxes And Spending In Nebraska Taxes And Spending In Nebraska Removing Barriers In Nebraska Part Three How Our Taxes And Spending Compare General Fund Receipts Nebraska Department Of Revenue Nebraska Sales Tax Rates By City County 2022 Taxes And Spending In Nebraska.

Select the Nebraska city from the list of popular cities. Nebraska provides no tax breaks for Social Security benefits and military pensions while real estate is assessed at 100 market value. The Nebraska NE state sales tax rate is currently 55.

Nebraska has a state sales tax of 55 percent for retail sales. The Nebraska state sales and use tax rate is 55 055. Nebraska also has special taxes for certain industries that may be on top of or in lieu of the state and local sales tax rates.

Local Sales Tax Range. The current state sales tax rate in Nebraska NE is 55 percent. Register for an account on.

Like all other goods retailers are required to charge a sales tax on the sales of all vehicles. There are provisions in Nebraska statutes that allow both cities and counties to. This takes into account the rates on the state level county level city level and special level.

In Nebraska the sales tax percentage is 55 meaning that you pay 55 of your vehicles value in addition to the total value of the car. 536 rows Nebraska has state sales tax of 55 and allows local governments to collect a. Colorado has the lowest sales tax at 29 while California has the highest rate at 725.

The Nebraska state sales and use tax rate is 55. As a business owner selling taxable goods or services you act as an agent of the state of Nebraska by collecting tax from purchasers. Five states have no sales tax.

The Nebraska income tax has four tax brackets with a maximum marginal income tax of 684 as of 2022. Many Nebraska cities levy local sales taxes in addition to the state rate. Detailed Nebraska state income tax rates and brackets are available on this page.

The original state sales tax rate was 25 percent. Estimates made recently by a professor at the school of business of the University of South Dakota Vermillion based on 1989 data calculates the business share of the Nebraska sales tax burden to be 40 in line with the national average of 41. Nebraska has a 550 percent state sales tax rate a max local sales tax rate of 250 percent and an average combined state and local sales tax rate of 694 percent.

Nebraskas Local Sales Tax. Vehicles are considered by the IRS as a good that can be purchased sold and traded. Average Local State Sales Tax.

Currently combined sales tax rates in Nebraska range from 5 to 7 depending on the location of the sale. The total tax rate might be as high as 75 percent depending on individual municipalities however food and prescription prescriptions are exempt. In Nebraska acquire a sellers permit by following the department of revenues detailed instructions for registration.

55 Rate Card 6 Rate Card 65 Rate Card 7 Rate Card 725 Rate Card 75 Rate Card 8 Rate Card Nebraska Jurisdictions with Local Sales and Use Tax Local Sales and Use Tax Rates Effective January 1 2021 Local Sales and Use Tax Rates Effective April 1 2021. Nebraska Sales Tax Rate The sales tax rate in Nebraska is 55. Nebraska also has a 558 percent to 750 percent corporate income tax rate.

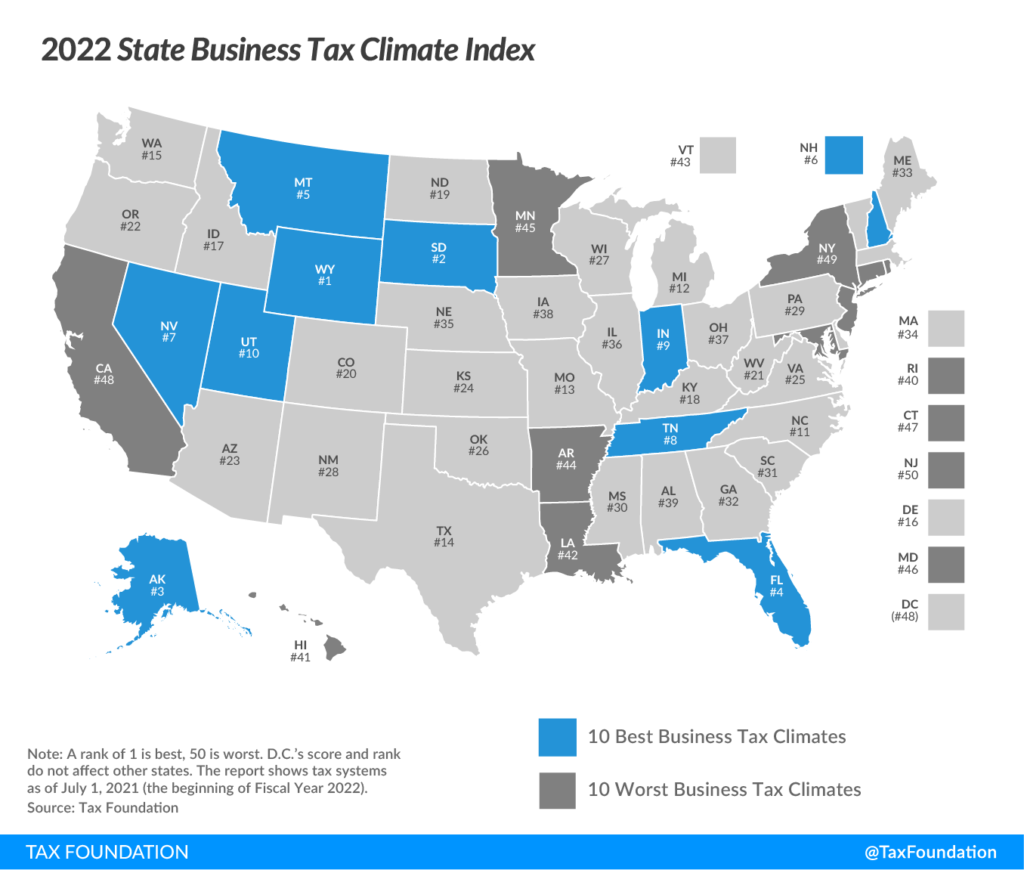

Nebraska has recent rate changes Thu Jul 01 2021. Base State Sales Tax Rate. Nebraskas tax system ranks 35th overall on our 2022 State Business Tax Climate Index.

The most populous county in Nebraska is Douglas County. Maximum Possible Sales Tax. Additionally city and county governments can impose local sales and use tax rates of up to 2 percent.

With local taxes the total sales tax rate is between 5500 and 8000.

Taxes And Spending In Nebraska

Taxes And Spending In Nebraska

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

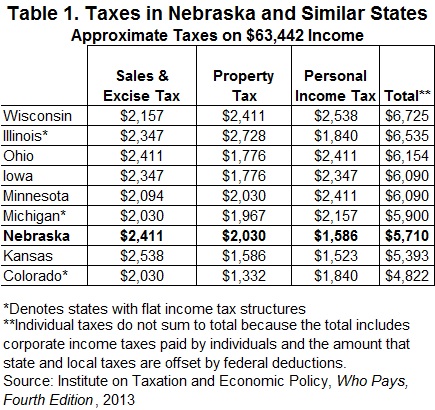

Policy Brief Typical Family Pays Less Tax In Nebraska Than In Most Similar States Open Sky Policy Institute

Taxes And Spending In Nebraska

Removing Barriers In Nebraska Part Three How Our Taxes And Spending Compare

General Fund Receipts Nebraska Department Of Revenue

Policy Brief Typical Family Pays Less Tax In Nebraska Than In Most Similar States Open Sky Policy Institute

Wfr Nebraska State Fixes 2022 Resourcing Edge

Taxes And Spending In Nebraska

Nebraska Sales Tax Small Business Guide Truic

Nebraska Drops To 35th In National Tax Ranking

Midwest State Income And Sales Tax Rates Iowans For Tax Relief